What is Indian Demand Draft

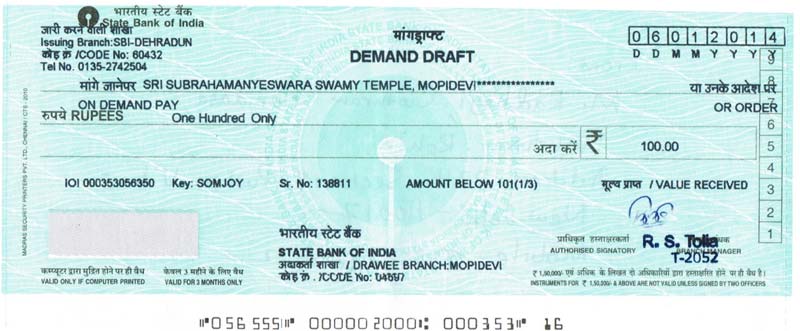

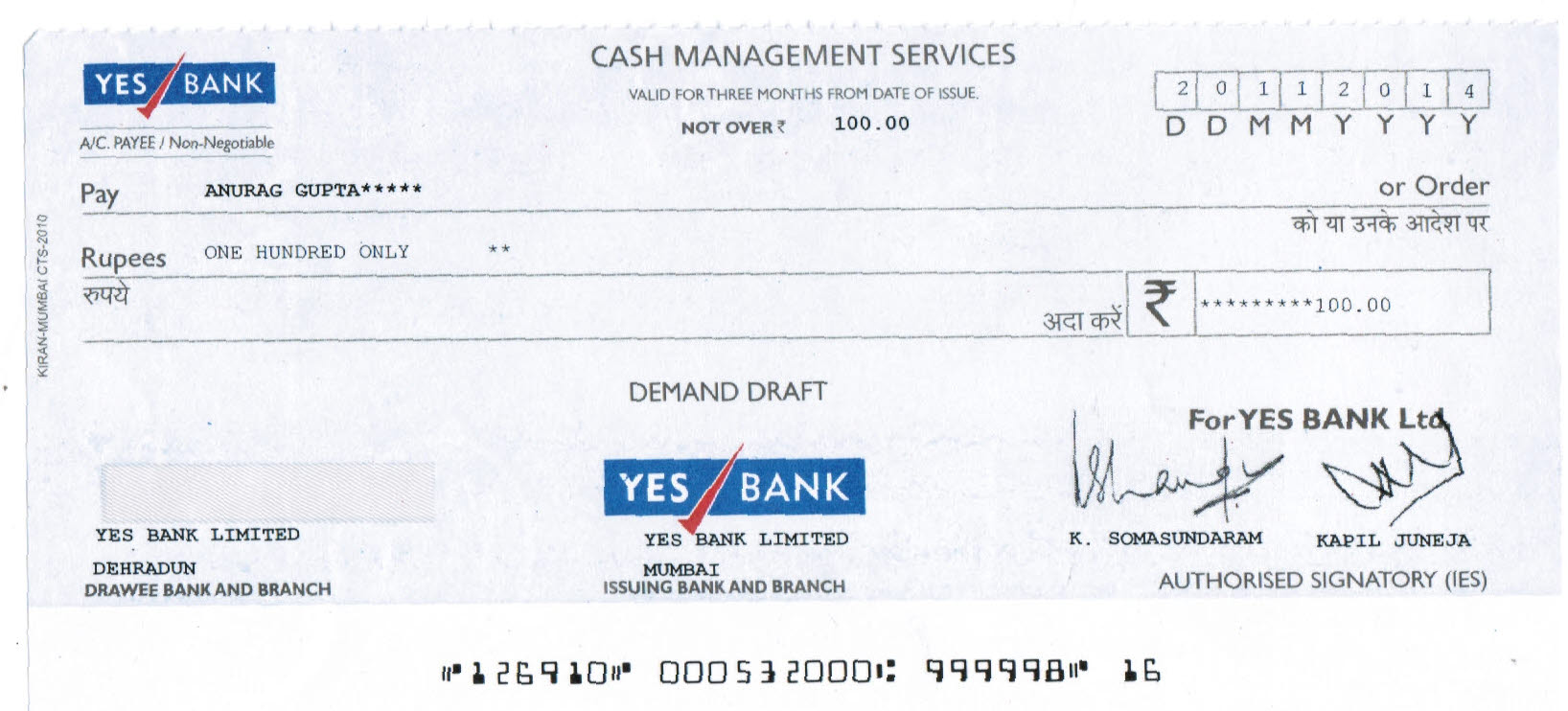

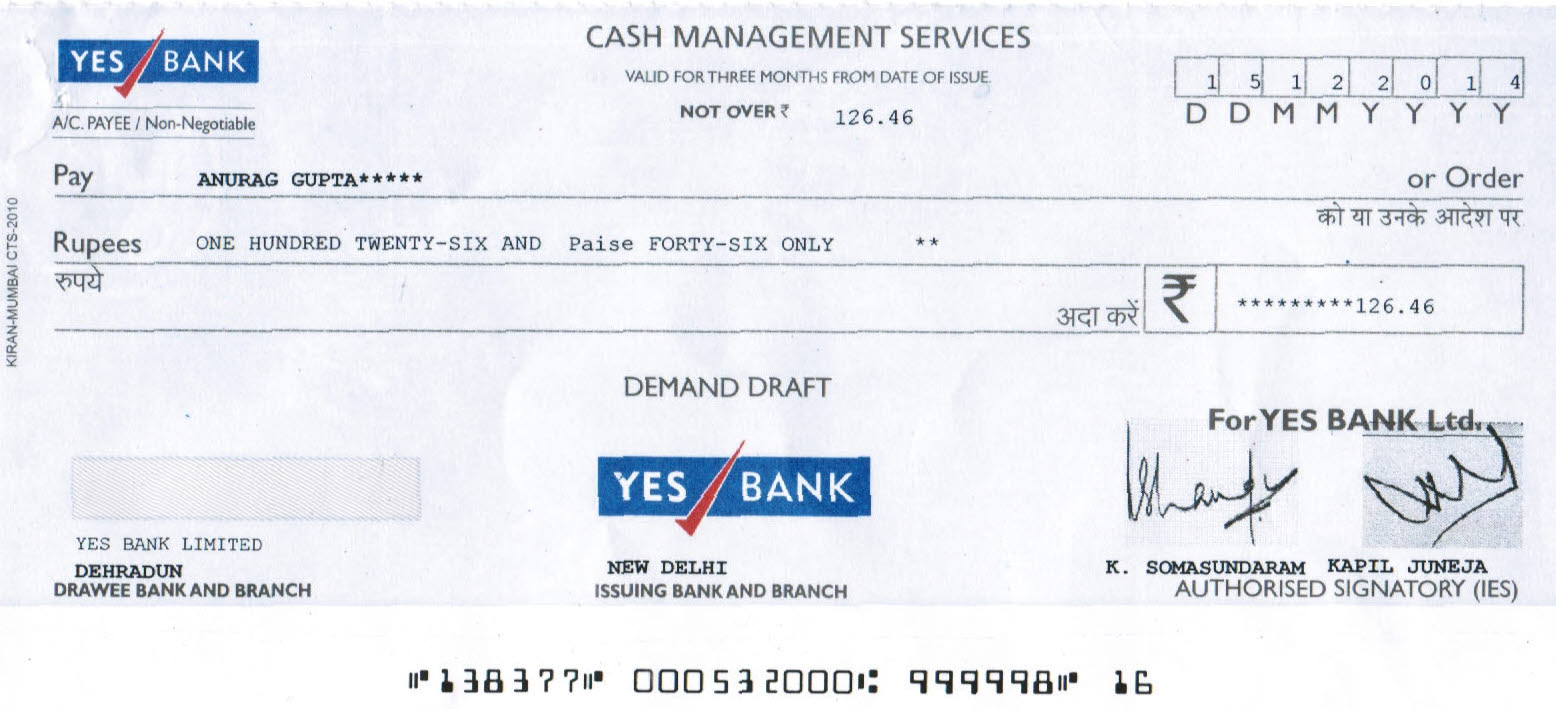

A Sample Demand Draft

The Demand Draft is an instrument used to transfer payments from one bank account to another. Demand Draft also is like cash, but much more secured than cash.

Some secured features are:

- Extremely unlikely to be stolen and used

- No chance of fake notes circulating in India

- Can be encashed only by the person on whom it is issued

- Can be easily carried, no threat to life due to robbers when carried

- Can be safely sent by courier or post

- Can be easily cancelled

- Sender can be easily identified

It is quite popular instrument. Also it's the preferred method of payment for applying any admission in institutes, paying fees, applying for subscriptions etc.

The method of filling a Demand draft

We have to provide certain information to the bank for buying a DD. For this we need to fill in an application-form which asks for the following information:

* The type of DD needed.

* The mode in which the money is paid i.e. through a bank account or in cash or cheque.

* The mode in which you will pay money to the bank i.e. by debiting to your account or by cash.

* The concerned place where the money is to be paid.

* Name of the recipient.

* The amount.

The Demand draft for the amount will be provided by the counter clerk when we present the application form along with the cheque on our account or if cash is deposited for the same amount.

Note: Some bank allow only customer to issue Demand Drafts.

Things to be noted while handling a Demand Draft.

1. The particulars like the name of the beneficiary, amount, and the place where payable etc. in the DD should be the same as what we have filled in the application form.

2. The spelling of the beneficiary’s name should be exactly the same.

3. We must get the Demand Draft crossed for security.

4. If the DD amount is more than Rs. 50,000 then the PAN number will be necessary.

5. The charge for taking a demand draft varies with the bank. If we have to take the DD for a large sum then it is better to reach for the bank which charges less.

Now a days DD can be ordered online too. This facility can be availed if you have online access to your bank accounts. If you are an NRI you can avail this facility.

Useful links(demand draft charges):

- ICICI Bank DD

- ICICI Bank DD charges

- HDFC Bank Demand Draft faq

- SBI Demand Draft

- PNB DD charges

Comfort of Ordering Demand Draft

In India currently it is somewhat difficult to order DD's. You'll have to stand in long queues, especially if you going to any PSU banks like SBI. Be ready to shell you 1-2 hours in PSU banks in India.

There no online services to the comfort of ordinary public who can order small amount demand drafts and send it instantly. However banks have started giving online DD ordering facility. But it is cumbersome.

Charges

Currently charges for Demand Draft vary. However among private sector banks it is competitive. DD's in the higher range cost you Rs 2/per 1000 Rupees of DD made. If you order DD through internet it'll cost less than ordering from the bank clerk in the private banks, but you'll need to pay the courier charges. If you're having account with SBI and ordering through internet then it is coming out to be cheapest amount all banks. I've an ICICI bank salary account and they are giving up Rs. 25000 DD per month free of cost. Also some banks charge you extra buck if you are not a bank account holder. In general lowest cost of DD will not be less than Rs. 50.

Comments

DD cancellation Latter

Demand Draft Cancellation Letter (Cash and Cheque Based)

What is DD or Demand Draft?

DD Cancellation Letter – DD stands for demand draft. A dd or a demand draft is a negotiable instrument that the bank provides to its customers. A negotiable instrument refers to a guarantee for an amount of payment giving the name of the payee. The demand draft is a non-transferrable instrument.

What do you mean by a DD cancellation letter?

DD cancellation letter is needed when you have the finalized demand draft; the total money will be deducted or subtracted from your account. If you want to cancel the demand draft, it can only be done by the bank. You would need to visit the branch of your bank personally and will have to request the cancellation of your demand draft.