Updated on Thursday, 18 September 2025 - 5:44pm

हिंदी में पढ़ें

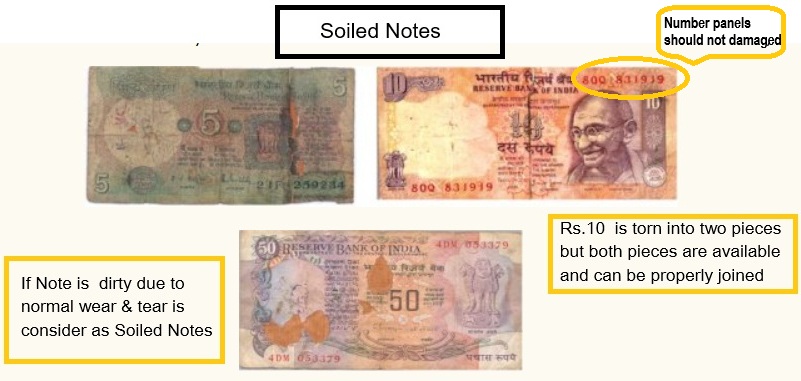

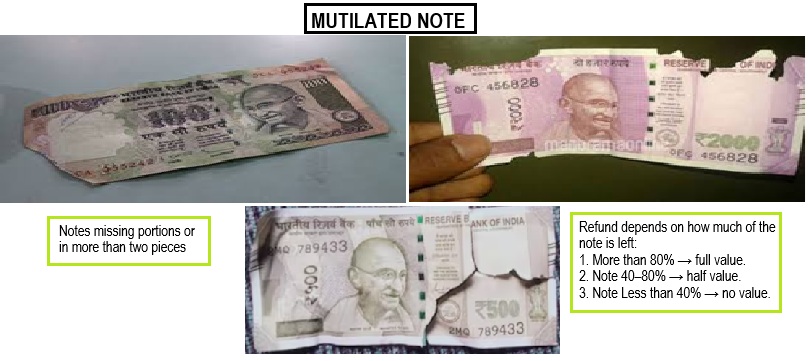

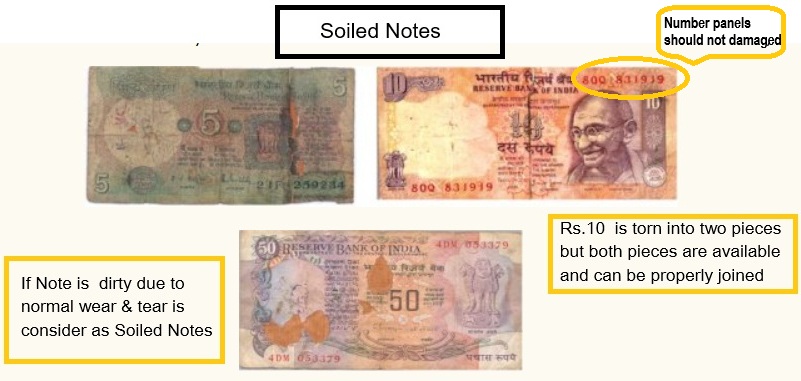

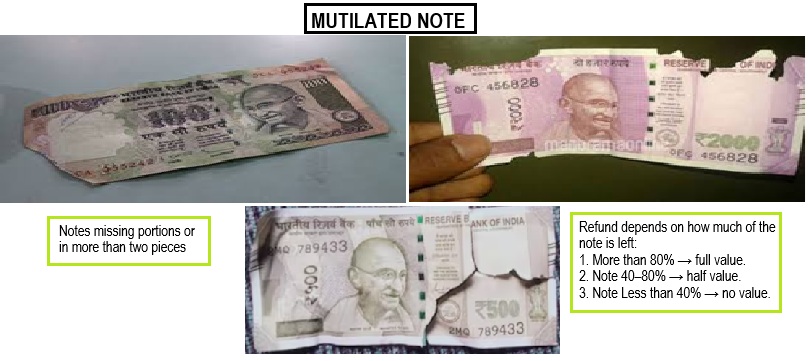

Types of Damaged Notes

To expand image

To expand image

To expand image

To expand image

Procedure To Exchange Notes

1. At Any Bank Branch

- Soiled notes: Up to 20 pieces or value up to ₹5,000 → exchanged immediately, free of charge.

- Larger numbers/value → bank accepts, gives receipt, credits value later (may charge service fee).

- No form required. Even non-customers can use this.

2. At Currency Chest Branches

- For mutilated or imperfect notes (missing parts, multiple pieces).

- If 5 pieces or less then 5, branch may pay immediately. If unable, they send to linked currency chest.

- If there are 5 pieces or more, if the value exceeds ₹5,000, approach the currency chest directly or send them by insured post.

- Refund credited within 30 days.

3. At RBI Issue Offices

- For severely damaged notes (burnt, brittle, charred, inseparably stuck).

- Banks are not obliged to accept these, so go directly to RBI Issue Office .

- RBI adjudicates under Note Refund Rules and pays applicable value.

4. By TLR Cover / Registered Post

- TLR = Triple Lock Receptacle, available at RBI offices .

- Used for mutilated notes. You fill details (name, address, denomination, bank a/c) and deposit or post.

- RBI examines and refunds later via bank credit / draft.

Key Points to Remember

- Essential features (watermark, signature, RBI name, etc.) must be visible.

- Refund depends on note size left:

- Note is 80% → full value (₹50 & above).

- Note 40-80% → half value.

- Note is less then 40% → no value.

- For notes up to ₹20, more then 50% area must be intact for full value.

- Banks must exchange for all, not only their own customers.

- If refused, you can complain under RBI Complaint Management System (CMS) Portal .

Comments

Rat eats my notes.

Rat eats my four 100 rupees notes. Can I exchange them from banks?